Renters Insurance in and around Aurora

Aurora renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Trying to sift through providers and deductibles on top of keeping up with friends, managing your side business and family events, takes time. But your belongings in your rented condo may need the terrific coverage that State Farm provides. So when the unexpected happens, your videogame systems, home gadgets and sports equipment have protection.

Aurora renters, State Farm has insurance for you, too

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

You may be wondering if Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the condo. How much it would cost to replace your personal property can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when abrupt water damage from a ruptured pipe occurs.

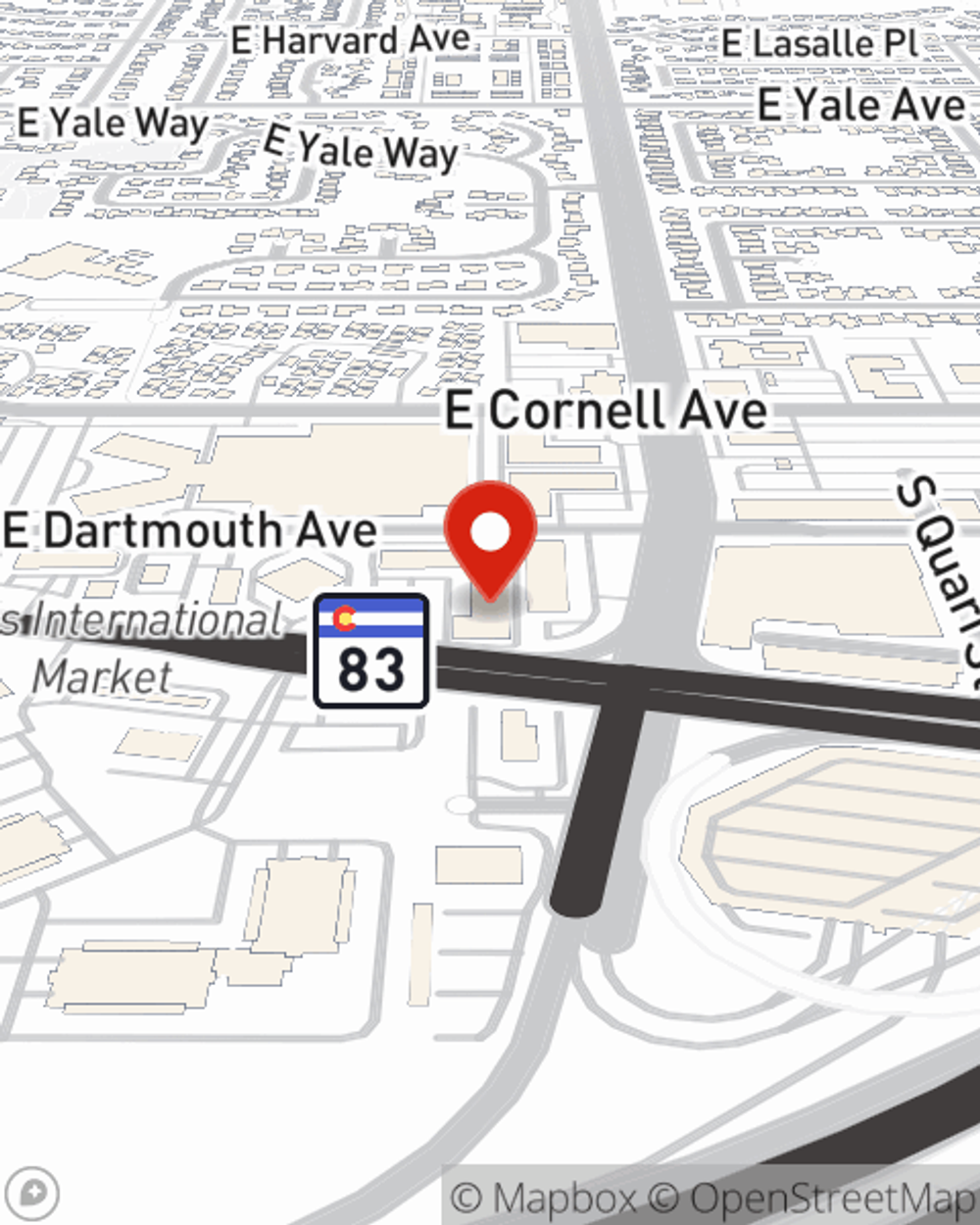

As a commited provider of renters insurance in Aurora, CO, State Farm strives to keep your belongings protected. Call State Farm agent Mike Gibbs today for help with all your renters insurance needs.

Have More Questions About Renters Insurance?

Call Mike at (303) 699-2800 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.